On Thursday 14 November 2020, the European Investment Bank (EIB) adopted a new energy lending policy and confirmed the EIB’s increased ambition in climate action and environmental sustainability. In practice, the EIB voted to end financing for fossil fuel projects from the end of 2021. From 2025, 50% of its investments go to climate and sustainable investment projects. The EIB Group will align all financing activities with the goals of the Paris Agreement from the end of 2020. As the think-tank E3G well summarises: “This is a clear signal to markets around the world that [polluting] technologies have become inherently risky in the context of global climate ambition.”

To achieve the EU’s 2030 targets agreed in Paris, including a 40% cut in greenhouse gas emissions, Europe has to fill an investment gap estimated at 180 billion EUR per year. According to the 2050 European plan, more than €500 billion will be needed every year to decarbonise the entire EU economy by mid-century. The EIB says its new policy will unlock EUR 1 trillion of climate action and environmentally sustainable investment in the decade to 2030. This is in line with the ambitions announced by (future) Commission President Ursula von der Leyen, and the Sustainable Europe Investment Plan and the Green Deal her team will be carrying.

The new energy lending policy details five principles that will govern future EIB engagement in the energy sector:

- prioritising energy efficiency to support the new EU target under the EU Energy Efficiency Directive

- enabling energy decarbonisation through increased support for low or zero-carbon technology, aiming to meet a 32% renewable energy share throughout the EU by 2030

- increasing financing for decentralised energy production, innovative energy storage and e-mobility

- ensuring grid investment essential for new, intermittent energy sources like wind and solar as well as strengthening cross-border interconnections

- increasing the impact of investment to support energy transformation outside the EU.

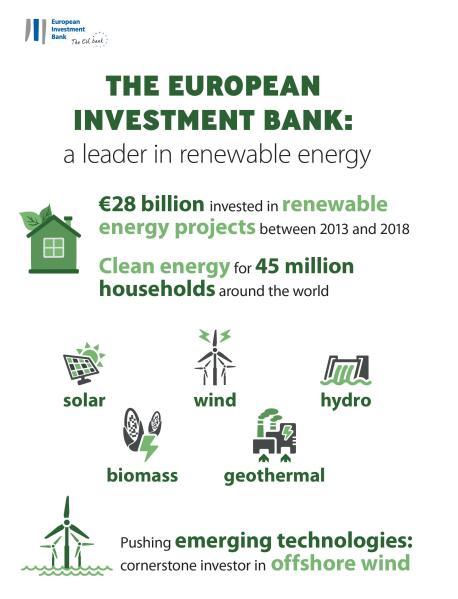

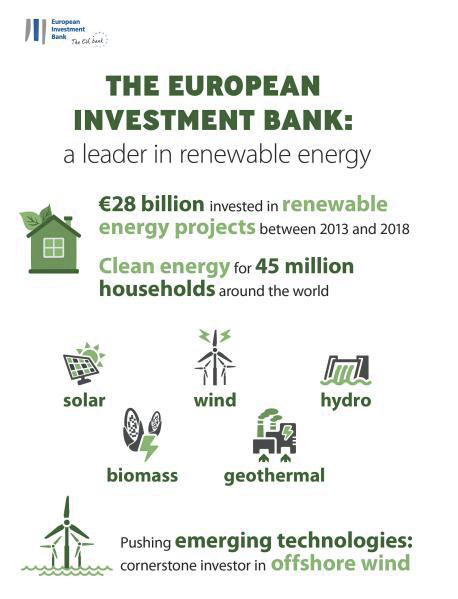

The bank is already the largest multilateral provider of climate finance worldwide, with 25% of its total financing dedicated to climate investment. The EIB is also one of the world’s biggest financiers of energy projects. In 2013-17, the energy projects the Bank signed resulted in avoided emissions annually of about eight million tonnes of CO2, equivalent to emissions from 1.7 million cars driven for one year. In the last five years alone, the EIB provided over €50 billion in energy investment in Europe and around the world to renewable energy, energy efficiency and electricity grid projects. This lending helped make solar and wind power much cheaper, with costs down 73% and 22% respectively since 2010. By 2050, energy costs could fall from 5% of global GDP to a little over 2%.

A large consensus

Environmental associations and a large majority of stakeholders are saluting the agreement. However, the Green Party of the European Parliament reminds that moving away from gas completely has been delayed for two years and that the next two years will be critical to “see a complete shift away from polluting investments”. The association Eurogas sees the EIB’s vote as an opportunity to accelerate the pace of development of alternative technologies and sources of gas (deployment of carbon capture and storage (CCS), power-to-gas, hydrogen and biogas) and see this decision “a major step towards achieving the carbon neutrality targets of 2050” supported by the association. However, IGU, one of the international gas unions, opposes the EIB’s decision, arguing that technologies can make natural gas “a practically emission-free fuel” and that the EIB “prematurely [chose] winners and losers”.

What impact on the people?

As the European Commission recalls, the clean energy transition should be gradual, socially fair, based on a broad range of energy sources and technologies and done in a way that no region is left behind.

The EIB decision should have a significant impact on jobs: since 2012, the number of renewable energy jobs has grown 45% worldwide, compared to an increase in all jobs of only 5%. In the EU, renewable energy jobs more than doubled since 2000, against a 7% overall increase in jobs.

In the past years, the EIB spent €2.5-5 billion per year in energy efficiency projects, with a record year of nearly €5 billion in 2017. The November agreement will enable to release even more funds for energy efficiency and supporting the new EU target under the EU Energy Efficiency Directive. The European Commission considers energy efficiency as one of the strategic priorities for the Energy Union and promotes ‘energy efficiency first’ as a principle. By using energy more efficiently, energy demand can be reduced, leading to lower energy bills for consumers, lower emissions of greenhouse gases and other pollutants, reduced need for energy infrastructure, and increased energy security through a reduction of imports. Worldwide, the International Energy Agency (IEA) has found that “energy efficiency retrofits in buildings (e.g. insulation retrofits and weatherisation programmes) create conditions that support improved occupant health and well-being, particularly among vulnerable groups such as children, the elderly, and those with preexisting illnesses. Several studies that quantified total outcomes found benefit-cost ratios as high as 4:1 when health and well-being impacts were included, with health benefits representing up to 75% of overall profits. Improved mental health (reduced chronic stress and depression) has, in some cases, been seen to represent as much as half of the total health benefits.”[i]

Energy inefficiency is one of the main causes of energy poverty, so dedicating more funds is a way to address the phenomenon directly. But it would still need to be addressed by the Member States: draft national energy and climate plans (NECPs) presented earlier this year still treat these long-term measures for vulnerable households far too superficially.

Involving the private sector

The European Commission and the EIB are very much aware that public finances alone will not be enough. As Mrs von der Leyen pointed out, “we need to tap into private investment by putting green and sustainable financing at the heart of our investment chain and financial system. To achieve this, [the Commission] intends to put forward a strategy for green financing and a Sustainable Europe Investment Plan [and] turn parts of the European Investment Bank into Europe’s climate bank”.

In the field of building renovation, in cooperation with the European Commission, the EIB will establish a new European Initiative for Building Renovation (EIB-R) to support new ways to attract finance for building rehabilitation. This will examine the development of relatively new sources of energy efficiency finance, such as models of mortgage-based lending. Given the pressing need to accelerate market uptake for energy efficiency, and as an exception to its general rule, the Bank will consider financing up to 75% of eligible capital expenditures under this initiative.

In parallel, the EU has already been working at attracting the required “Green investments” with the European Fund for Strategic Investments. However, the scale of the investment challenge is beyond the capacity of the public sector alone. The financial sector has a key role to play in reaching those goals. It can re-orient investments towards more sustainable technologies and businesses finance growth in a sustainable manner over the long-term contribute to the creation of a low-carbon, climate-resilient and circular economy.

More than ever, bridging those ambitions with private banks the local level is essential. As Andrew McDowell, Vice-President of the EIB, said in a recent interview, local banks and pension funds will have to be part of the financial solution. These “vital players” need the support of large multilateral financial institutions because they still lack technical expertise and financial experience in the energy sector. He also added that “global investment in research and development in renewable energy is still much too low. The global number in 2017 was $32 billion, of which $22billion was provided by governments. That is half of what the EU automotive industry alone invests each year in R&D. Success also depends on the solar panels on your roof and financing from the bank on the corner of your street. In less mature energy sectors, such as energy efficiency and small-scale off-grid renewables, there is room to grow.”

The next steps

The European Commission appointed a High-Level Expert Group on sustainable finance at the end of 2016, which published its final report in January 2018. It concludes that sustainable finance had two urgent priorities: 1. improving the contribution of finance to long-term society’s needs and 2. strengthening financial stability by incorporating environment, social and governance (ESG) factors into investment decision-making.

In March 2018, the European Commission published an Action Plan on sustainable finance, targeting 3 main objectives:

- Reorientation: reorient capital flows towards sustainable investment in order to achieve sustainable and inclusive growth

- Mainstreaming: manage financial risks stemming from climate change, resource depletion, environmental degradation and social issues

- Transparency: foster transparency and long-termism in financial and economic activity

This Action Plan led to the publication of three legislative proposals. In February 2019, the European Parliament and the Member States agreed on new EU rules for the creation of benchmarks for low-carbon investment strategies. In March 2019, the EU agreed on new rules on disclosure requirements related to sustainable investments and sustainability risks were agreed. Now, the Commission is still working with the co-legislators with the objective to reach an agreement on the remaining part of the package: the Commission proposal to establish a unified EU classification system (‘taxonomy’) of sustainable economic activities.

On 18 October 2019, on the margins of the International Monetary Fund (IMF)/World Bank annual meetings in Washington DC, the European Union together with relevant authorities from Argentina, Canada, Chile, China, India, Kenya and Morocco, launched the International platform on sustainable finance (IPSF). The ultimate objective of the IPSF is to scale up the mobilisation of private capital towards environmentally sustainable investments. The IPSF is a forum to strengthen international cooperation and, where appropriate, coordination on approaches and initiatives for the capital markets (such as taxonomies, disclosures, standards and labels), that are fundamental for private investors to identify and seize environmentally sustainable investment opportunities globally.

—

EIB deciding to divest from fossil fuels is proof that Europe is serious about becoming the champion of decarbonisation and climate change mitigation. Climate change poses global challenges affecting each of us, more or less violently. Massive investments will be needed to shift to a low carbon economy. Public funding is vital for the transition but it will not be enough. A substantial part of the financial flows will have to come from the private sector.

The energy and climate transition will be inclusive, just and fair or will never happen. Sustainability, energy efficiency policies, highly ambitious renovation policies, urban resilience programmes, strategies to address energy poverty as well as programmes to equip everyone with the right tools and skills need to be financed, not fossil fuels.

As citizens, we therefore also have a responsibility to turn to financial products and services that are ambitious from a climate and social point of view. Our values are also expressed in our consumer choice-making.

One Response